“STOP LOSS CRYPTO WALLET: Managing the risk of investment successful”

Risk management in the world’s cryptocurrency is very important to avoid major losses. An effective way to manage risk is to use the interruption cryptocurrency wallet that helps traders set boundaries and limit their possible losses. Here is an article explaining how to use a cryptocurrency wallet for loss of loss, its advantages and best practices.

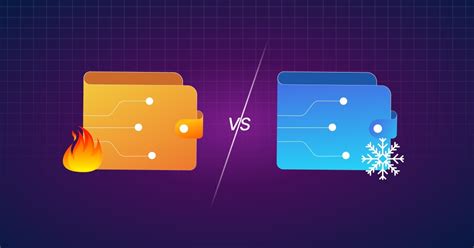

What is the Stop-Mess cryptocurrency wallet?

The Stop-Sloss cryptocurrency wallet is a digital wallet designed for special cryptocurrency investments. This allows consumers to define a predetermined price level as a goal of their investment known as “stop”. When the property price reaches or falls below this limit, the consumer can sell their currencies, record profits and limit possible losses.

** The benefits of stop cryptocurrency for loss

- Risk Reduction : When detecting suspension loss, traders may reduce the risk of significant loss due to market volatility.

2.

- Flexibility : Many Stop-Perda wallets offer several options to define price limits that allow users to adapt their risk management strategy.

- Easy to use : Cryptocurrency portfolios for loss of loss are comfortable and easy to define, facilitating the beginning of new traders.

The best practice of using the cryptocurrency wallet for loss of loss

1

2.

- This can help determine more realistic suspension loss prices.

- Observe your wallet : Regularly check any potential loss in your wallet and adjust the settings if necessary.

STOP-STOP-STOP-POPULAR STOP-STOP-STOP CREATE COVERNESS

1

- Kraken Wallet

: “Kraken’s Stop-Stop wallet offers users the ability to define multiple price levels and time degradation options to ensure at risk flexibility.

- CRYPTOSLA STOP LOSS WALLET : Cryptoslate offers a convenient downtle eyelash, providing real -time market data and custom settings.

Conclusion

Stop-Sloss cryptocurrency wallet can be an effective way to boost traders risk and achieve their investment goals. By setting real price thresholds using some limits and monitoring your regular wallet, you can protect yourself from large losses. Remember to be informed of market fluctuations and adjust the risk management strategy if necessary.

Refusal of responsibility : This article is not intended to invest tips. Cryptocurrency negotiation poses a significant risk, including the loss of basic investment. Before investing in cryptocurrencies, always do detailed research and consider your financial situation.