Choosing Between REST API and WebSocket for Buying Assets: A Comparison

As an e-commerce platform owner looking to integrate cryptocurrency buying functionality into your application, you may have considered using either a Rest API or a WebSocket-based solution. While both options offer advantages, they cater to different use cases and trade-offs between speed, reliability, and scalability.

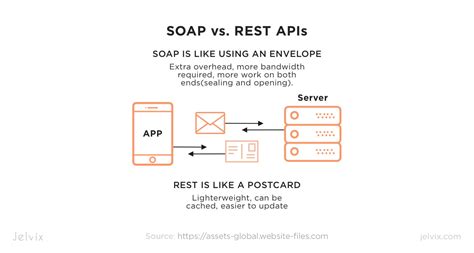

REST API

A REST (Representational State of Resource) API is an architectural style that provides a fixed, predictable interface for interacting with resources on the server. When it comes to buying assets, a REST API can be used to retrieve data from exchanges like Binance or Kucoin in real-time. Here are some key benefits of using a REST API:

- Fast and efficient: Data fetching is typically faster than using Websocket because it relies on HTTP requests and responses.

- Scalability: REST APIs can handle high volumes of concurrent requests without sacrificing performance.

- Easy to implement: Many exchanges provide pre-built RESTful APIs for common use cases, making it simple to integrate with your application.

However, there are also some potential drawbacks to consider:

- Lack of real-time updates

: If you need to receive price updates in real-time, a REST API might not be the best choice due to latency constraints.

- Limited control over data fetching: You may have limited control over how data is fetched and processed by the exchange.

WebSocket

A WebSocket is an application-layer protocol that enables bidirectional, low-latency communication between a client (your application) and a server. When it comes to buying assets on exchanges like Binance or Kucoin, Websocket offers several benefits:

- Real-time updates: Websocket allows for instant price updates, making it ideal for applications requiring real-time market data.

- Full control over data fetching: You can choose which data points you want to receive and when, giving your application more flexibility and control.

However, there are also some trade-offs to consider:

- Slower data fetching: Websocket requests are typically slower than REST API requests due to the overhead of establishing a persistent connection.

- Larger bandwidth requirements

: Exchanges often require larger bandwidth to handle the increased traffic generated by WebSocket connections.

Choosing the Right Approach

Considering your application’s requirements, it’s essential to weigh the pros and cons of each approach. Here are some questions to ask yourself:

- Do you need real-time price updates?: If yes, a WebSocket might be a better choice due to its ability to provide instant updates.

- Are latency constraints a concern?: If your application doesn’t require real-time updates, a REST API could be sufficient.

- Do you want full control over data fetching?: If so, choosing a WebSocket-based solution might give you more flexibility.

Recommendation

If I were you, I would recommend using a WebSocket-based solution for buying assets on exchanges like Binance or Kucoin. This allows for real-time price updates and provides instant feedback to your application. However, if latency constraints are a concern or you prioritize ease of implementation over real-time updates, a REST API might be a suitable alternative.

Additional Tips

Regardless of which approach you choose, consider the following best practices:

- Test thoroughly: Validate that both APIs respond as expected and handle edge cases correctly.

- Use caching mechanisms: Implement caching to reduce the number of requests made to the exchange’s servers.

- Monitor performance: Continuously monitor your application’s performance under different load scenarios to ensure optimal performance.