Analyzing Economic Indicators for Trading Ethereum Classic (etc)

As the value of cryptocurrencies continues to float, traders and investors are constantly seeking new ways to identify trends and make informed decisions. An effective method is to analyze economic indicators that have a direct impact on the price movement of a specific cryptocurrency, such as Ethereum Classic (etc). In this article, we will explore some important economic indicators for negotiation etc and provide guidance on how to use them.

What are economic indicators?

Economic indicators are statistical data points that provide information on the overall health of an economy. They can be used to predict future cryptocurrency price movements, identifying patterns and trends in underlying economic data. In the context of trading of etc, some important economic indicators include:

* Interest rates : Changes in central bank interest rates can affect the demand for cryptocurrencies as etc.

* Inflation rate : High inflation can lead to an increase in demand for cryptocurrencies, increasing its value.

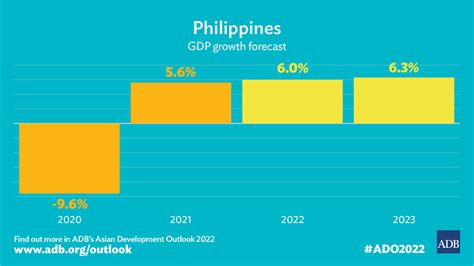

* Gross Domestic Product (GDP) : A strong GDP indicates a healthy economy that can positively impact cryptocurrency prices.

* Unemployment Rate : Low unemployment rates can increase growth and economic interest in cryptocurrencies.

How to analyze economic indicators for negotiation etc

To analyze these indicators effectively, follow these steps:

- Choose the right indicators

: Select a combination of indicators that have been proven effective for negotiation etc. Some popular options include:

* Interest rate: Observe the interest rate of central banks in countries with significant economic activity.

* Inflation rate: Verification inflation rates in countries with high GDP growth.

* GDP: Monitor the country’s GDP growth to evaluate its general economic health.

* Unemployment Rate: Observe unemployment rates in the main sectors of the economy.

- Create an Indicator Panel : Configure a panel with the chosen indicators using tools such as TradingView or Cryptography. This will help you visualize and analyze data more easily.

- For example:

* Short term (1-5 days): Look for sudden changes in interest rates or inflation rate.

* Medium term (1-30 days): Focus on GDP growth and unemployment rates.

4.

5.

Successful negotiation tips etc

When analyzing economic indicators can be a valuable tool in the right hands, it is essential to remember that there is no unique indicator that guarantees success. Here are some additional tips to be remembered:

* Keep disciplined : Avoid being caught in emotions and makes informed decisions based on data analysis.

* Stay up to date

: Stay informed about market news and economic updates to adjust your agreement.

* Diversify your portfolio : Do not put all your eggs in a basket. Diversification can help you manage risks and increase potential returns.

By incorporating these economic indicators into their negotiation strategy, traders can better understand underlying economic data that boost cryptocurrency prices. However, it is crucial to remember that there is no substitute for experience and market knowledge when it comes to making informed investment decisions.