Cryptumelute Trading Open Interest Power

The crypto currency world is an expression that traders and investors often misunderstand or forget. However, it plays a key role in determining market feelings, volatility and liquidity. In this article, we will investigate what open interest points to future trade in cryptocurrency trade.

What is the open interest?

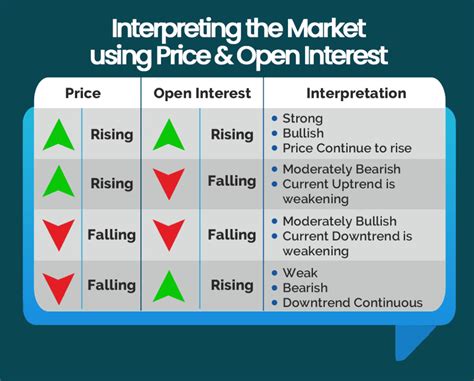

Open interest refers to the total number (or future) of contracts open to marketing or markets. This is the measure of what interest rates exist in the purchase and sale of a certain currency pair at a certain price level. When open interest rates, this means that more merchants are interested in participating in the market, which can lead to higher prices and higher volatility.

Open interest in cryptocurrency trade

The crypto currency shop has open interest is particularly important for the relations with the feelings and liquidity of the market. Here’s how:

* Market Mood : As the open percent increase, this suggests that more merchants are optimistic about a particular mysterious currency or asset class. This can lead to higher prices and higher demand for property.

* Vesency

: Higher open interest rates also indicate increased volatility in the market. When more merchants are buying or selling, the price can change quickly, which can be useful for short -term traders who want to benefit from the market swing.

* Liquidity : Open interest is the main liquidity rate in cryptocurrency markets. High open interest usually means that there is higher demand for property, leading to higher prices and better trade conditions.

Examples:

* Bitcoin (BTC) Trade : From 2021. Bitcoin had open interest on approximately 4 million contracts on major stock exchanges such as Coinbase and Binance. This high level of open interest rate has contributed to the strong price impulse over the past year.

* Ethereum (ETH) Trade : Ethereum’s open interest is also relatively high, and about 2 million contracts are traded in the main stock exchanges.

Why open interests are important to sell the future

Open interest in trade in cryptocurrencies serves a number of purposes:

1

Market Analysis : Open interest analysis, traders can assess market feelings and potential prices.

- Risk Management : Traders can use open interest rates to assess the risk that you enter the store or call. If more customers are interested than the seller, prices are likely to rise.

3

Position Size : Open interest helps traders determine how much they want to invest in a particular property before setting the position.

Conclusion

The critical aspect of the trade in the trade in cryptography is open because it provides a valuable insight into the mood and liquidity of the market. Understanding open interest, merchants can make more information decisions when entering or undergoing positions, managing the risk and increasing their potential benefits. As the cryptocurrency space is still developing, the key to the future of the future will still be the key to merchants and investors who want to move with this exciting and quick change in the landscape.

Additional resources

If you are interested in learning more about cryptocurrency trade, here are some additional resources:

* Cryptocurrency Trading Platforms : Coinbase, Binance, Kraken

* Trade Strategies : Risk Management Strategies, Position Size Techniques

* Market Analysis Tools : Technical indicators such as variable average and RSI

Be in the future with the latest achievements in cryptocurrency markets, you can use open interest as valuable information on your trade decisions.